Blog

Capital region’s real estate slowdown turns around in May with strong sales

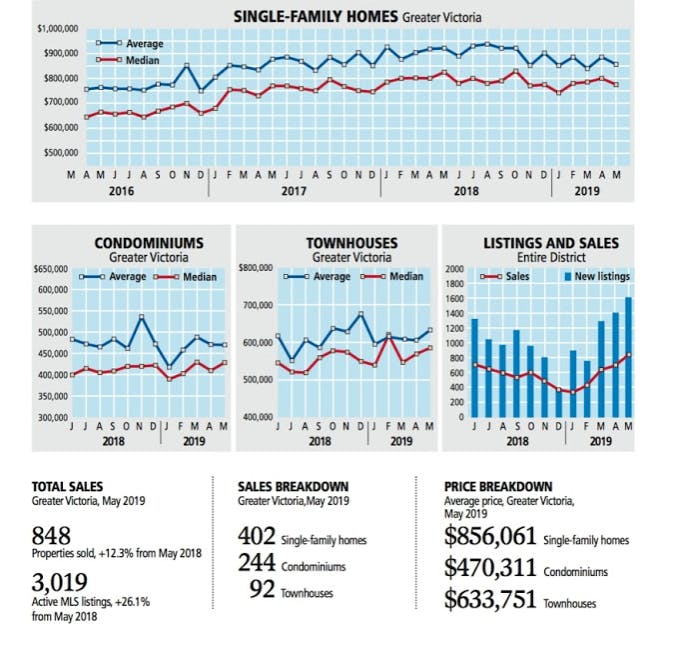

The capital region real estate market’s slow start to 2019 appears to be a thing of the past, according to numbers released Monday by the Victoria Real Estate Board.

Last month, the number of sales and the number of listings both jumped significantly compared with last month and last year.

There were 848 sales last month in the region, up from 696 in April and the 755 recorded in May last year. There were 3,019 active listings at the end of May, a 9.7 per cent increase over April’s 2,751 and a 26.1 per cent increase over the 2,394 listings at the end of May 2018.

Cheryl Woolley, president of the board, said it’s hard to say what was behind the slow start or the improved May numbers.

Recommendation

April 2019

Deedrie Ballard,

Remax Camosun

Dear Deedrie,

We want to thank you very much on the sale of our home. You listed and sold within a month at a time when the market is very difficult for sellers.

As you know, we tried to sell our house ourselves. We got an MLS listing and held open houses. We had interest at the open houses, many people came and many said they really liked the house, the price and the location, but none of that interest turned into a sale.

Even though we had over 50 groups of people look at our home during the open houses we held, you still had over another 30 at your first open house, plus 8 individual showings in the first week! It appears that the reach of professional realtors is greater than what a private homeowner can do. Thank you!

I believe that people really feel they must have a professional to guide them and let them know the pros and cons of the process of buying a home. A realtor is both trustworthy and independent. They have no underlying interest in the home… and also know which professional to go to for questions if the buyer has any. It is a big expenditure- the biggest the buyer will ever make! And, not one done very often.

We appreciate the help you gave us.

Best regards, G.M. AND M.H. Previous Oak Bay homeowners!

November Update

It’s hard to believe that is Christmas only a month away, which also means that the busiest time for real estate is just around the corner. Will your home ready to sell when the New Year comes along?

Before the bustling holiday season gets underway, now is the perfect time to take a walk around your home. Take an honest look. Do you really need the dried flower arrangement your kids made for you in 1995? Has the paint seen better days? Have knick-knacks and kitchenware taken over your countertops?

The old saying, “You never get a second chance to make a first impression,” is never more true than when you decide to put your home on the market. Did you know that a cluttered home makes your home appear smaller? Not only does that leave a negative effect on buyers, it will probably have a negative impact on OFFERS!

Don’t try to do it all at once, take it step-by-step, and room-by-room. The upside is knowing you won’t have to pack, store or move the things that don’t fit with your new home. Let your digital camera be your friend – take a picture of the things you can’t seem to let go; it lasts longer and takes up less space.

Still can’t part with those “seen better days” mementos? Overwhelmed? There are people who can help you and I know where they are!